Why Cash is King: Seizing Opportunities in Economic Uncertainty

Updated July 31, 2024

We received many emails when the markets were plunging, both from our free newsletter service and a few from the premium services. The common theme in around 90% of the emails was that we had lost our minds. 36% of those emails contained colourful language. For the record, most unsavoury emails originated from those who subscribed to the free newsletter. Most would have countered with a fiery response.

In contrast, we were delighted to receive such emails, for they informed us that the masses were dead wrong and why we would blast individuals going out of their way to provide such valuable data. We surprised some of the recipients by sending an excellent thank you note. Our free newsletter service has over 40K subscribers, and as such, it provides precious sentiment data.

Just remember, before you state you wish more people were/are more brilliant, picture how much harder it would be for you to navigate if all those around you were as sharp as you are. In the end, be thankful for the morons of the world, for they provide investors with valuable data that can be used to increase one’s net worth and stay out of harm’s way. Furthermore, this data reveals what we have always stated: that no good deed goes unpunished and that a good Samaritan usually ends up as a dead Samaritan. Never offer to help someone who does not seek it; they will likely string you up the nearest pole if you do so.

Cash is King Now: What About Tomorrow

Now, these wise guys who felt so smart by blasting the hell out of us during the market meltdown will weep tears of blood shortly if they are not already doing so. They made the same mistake, promising never to fall for the fake news/hysteria that made them dump their shares at the bottom.

But like mentally deranged individuals, they did precisely the same thing at the worst possible time, and what was their excuse; “it’s different this time”.Well, it will always be different, and that’s the excuse the masses will use forever to justify the fact that they let emotion overrule logic and sell when they should have been buying. Ultimately, this story will be repeated repeatedly because the mass mindset knows no better. Hence, the saying misery loves company, and stupidity demands it. Success is based on taking an approach bound to draw shouts of criticism from the masses. The only saying that comes to mind is the truth hurts, and boy does it.

Market Sucess equates to……?

To succeed in the market, you must control your emotions. However, this is not achieved via force, which never works in the long run. One has to come to the self-realisation that emotions are useless when it comes to investing. How is this achieved? Primarily via self-observation, the second factor is reading the right books. We have provided a list of books in the passcoded section of the website. One way to fast-track the enlightenment process is to view the stock market as one giant video game.

What is the biggest tragedy in one’s life? Your death. Yet, does one sit and obsess over this fact every single day? No one deals with it because one understands it’s inevitable. Thus, it’s pretty interesting, almost fascinating, that individuals can’t come to the same conclusion regarding corrections and crashes. The market will inevitably crash or correct sooner or later, but before the crash, the masses are always euphoric. Once in a while, as was the case recently, the massive correction is engineered. As a market crash is inevitable, so is an enormous recovery; the recovery phase is stronger and more rewarding than the crash phase.

Fear begets Fear

But the masses will never focus on this; they will focus on how the market could trend lower, why it’s not the right time to buy yet, or why it’s different this time and a host of other rubbish that makes no sense. And when the markets eventually surge to new highs, these penguins will look back in horror at how they did exactly what they promised never to do again. The sad part is that while they make the same promise again, they will react similarly the next time the market pulls back.

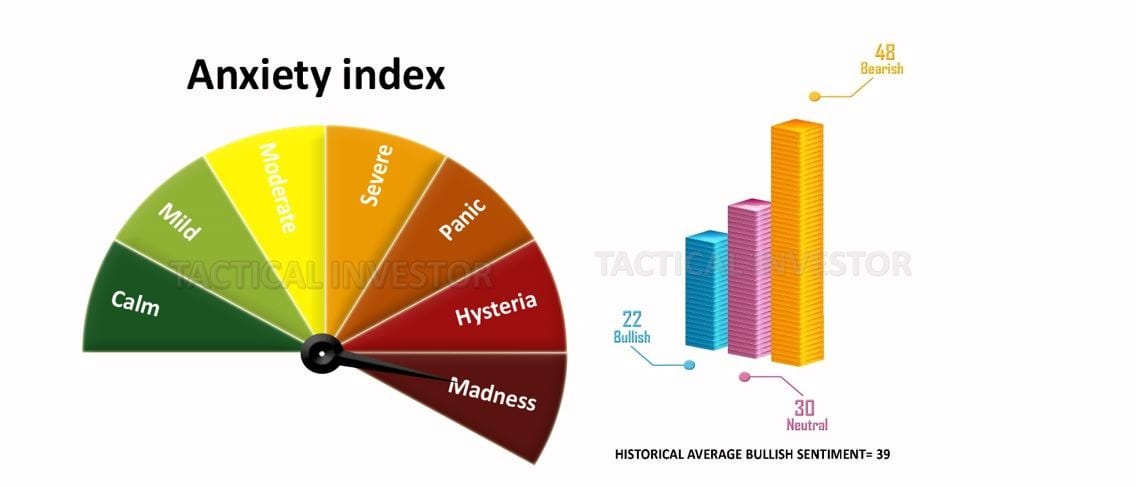

Investor Sentiment

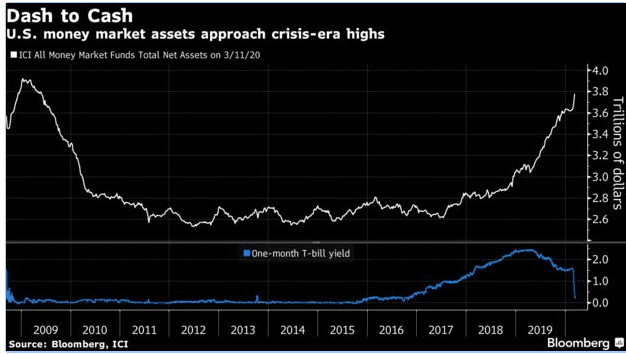

The crowd is still in a state of disarray, and this is probably what the Anxiety index is measuring. Look how they flock to money market funds that pay next to nothing, but they offer safety. Well, thank goodness for the mass mindset, for as they seek safety, we will do the opposite and keep buying.

These brilliant minds are holding 4.5 trillion in cash; what a feeding frenzy this will create when these enlightened (us being sarcastic) individuals finally realise it’s time to jump in. While they think cash is king, they will cry once the markets recoup most of their losses, for then the cash will lose its king status and join the ranks of the jokers.

Investors in China poured more than $141 billion into domestic money-market mutual funds in the first quarter, bringing the sector’s total assets under management near a record high. https://yhoo.it/3bTuu0y

China Mimicking the U.S?

The same phenomenon occurs in China, indicating that distance is not a limiting factor when dealing with the mass mindset. The more the crowd derides this market, the happier you should be.

In the age of coronavirus, cash is indeed king. That’s the view, at least, of many significant investors selling everything from stocks to bonds to gold to raise cash.

Bank of America Merrill Lynch, in its March Fund Managers’ Survey, indicated that month over month, cash among funds had seen the 4th largest monthly jump in the survey’s history, from 4 per cent to 5.1 per cent. Like buy-side fund managers, sell-side advisors also feel the need to be conservative, waiting on the sidelines for the market selloff to settle. https://cnb.cx/3bQmbCz

The saying should be changed to: in the age of ignorance, cash appears to be king but will soon face the same outcome the naked emperor did. It took a kid to point out the obvious that the dude was fat, naked and sorely in need of some shock therapy.

Investors made their most considerable dash for cash in history over the week that broke the bull market. They channelled $137 billion into cash-like assets and a record $14 billion into government bonds in the five days through March 11, according to Bank of America Corp. research citing EPFR Global data.. https://bloom.bg/2KOeG2Z

Shortly after this stampede, the markets bottomed—mass psychology in real-time. We hope your chaps kept a trading journal as suggested, for this crash will be remembered as one of the biggest B.S. crashes of all time. Or if we put it in terms of Aesop’s fables. This is a turbocharged version of the boy who cried wolf one too many times.

The cash is King Sop saga and why the markets are rallying so strongly

So why are the markets still rallying so strongly? They rallied strongly because the sentiment was decidedly bearish; all the other stuff the experts push out is just noise. The bearish sentiment has cooled off, and the markets are primed for a pullback, which took place on Friday.

The pullback will give the players who jumped in late a reason to believe that the bear is back, and that’s when they will get hammered. The subsequent pullback could be the last time players can load up on quality stocks at a low price. The odds of GOOGL trading to the level we opened our first positions at are very slim, and that applies to PJT, HALO and a host of other plays.

‘Don’t be fooled by the recent rebound in stocks; the investment scene is beginning to resemble the 1929 market crash and the early 1930s Great Depression.’ To me, it’s like 1929 when stocks first fell, then rallied before plunging anew as the Great Depression set in. In his Bloomberg piece, Shilling pointed to the 48% plunge in the Dow Jones Industrial Average from Sept. 3 to Nov. 13 back in 1929, a pullback which may have “seemed like a reasonable correction” at the time since the blue chips had rallied 500% in the eight years leading up to it. https://yhoo.it/3aVVY42

We hope these guys keep publishing articles like this, for it will add to the volatility, creating attractive opportunities to open even more positions at a discount. You have to love these guys; they preach gloom and doom when the Fed openly states they will do whatever it takes to support this market. You don’t fight the Fed when it puts the pedal to the metal.

Thank you for providing the essay and instructions. I’ll revise and update the content as requested, focusing on the topic of “Why Cash is King” in the context of investing. Here’s the expanded and improved version:

Why Cash is King?

In investing, the adage “cash is king” holds significant weight, especially during market volatility and economic uncertainty. While cash may not offer the highest returns, its value lies in its liquidity, stability, and versatility. Let’s explore why maintaining a healthy cash position can be crucial for investors.

Liquidity and Flexibility: One of cash’s primary advantages is its unparalleled liquidity. Unlike other real estate or stocks, cash can be immediately deployed for investments or used to cover unexpected expenses. This flexibility is precious during market downturns or economic crises.

The legendary investor Warren Buffett has long advocated for maintaining substantial cash reserves. In his 2014 letter to Berkshire Hathaway shareholders, Buffett wrote, “We will always maintain at least $20 billion—and usually far more—in cash equivalents.” This strategy allows Buffett to capitalize on opportunities that arise during market turbulence.

Stability and Risk Management

Cash serves as a stabilizing force in an investment portfolio. While other assets may fluctuate wildly, cash maintains its nominal value (though it may lose purchasing power due to inflation). This stability can provide peace of mind and buffer against market volatility.

Ray Dalio, founder of Bridgewater Associates, emphasizes the importance of cash in risk management. In his book “Principles,” Dalio states, “Cash is king, and it’s important to have enough of it to weather any storm.” He advocates for a balanced portfolio with a cash component to manage risk effectively.

Opportunity in Market Corrections

Perhaps the most compelling argument for holding cash is the ability to capitalize on market corrections or crashes. When asset prices fall significantly, investors with available cash can acquire high-quality assets at discounted prices.

Sir John Templeton, a pioneer in global investing, famously said, “The time of maximum pessimism is the best time to buy.” Cash reserves allow investors to act on this principle, buying when others are fearful, and prices are low.

Historical examples underscore this point:

1. During the 2008 financial crisis, Warren Buffett’s Berkshire Hathaway invested $5 billion in Goldman Sachs when the investment bank struggled. This move helped stabilize Goldman Sachs and yielded significant returns for Berkshire Hathaway.

2. In the March 2020 market crash triggered by the COVID-19 pandemic, investors who had cash on hand were able to buy stocks at steep discounts. The S&P 500 fell by about 34% from its peak but rebounded strongly in the following months, rewarding those with the cash and courage to invest.

Overcoming Psychological Barriers

Holding cash and deploying it effectively during market downturns requires overcoming psychological barriers. Daniel Kahneman, a Nobel laureate in economics, explains the concept of loss aversion in his book Thinking, Fast and Slow. He notes that “losses loom larger than gains” in our minds, making investing challenging when markets fall.

Conclusion: The Strategic Value of Cash

While it’s true that holding large amounts of cash can lead to opportunity costs in bull markets, the strategic value of cash becomes apparent during times of market stress. Cash provides liquidity, stability, and the ability to capitalize on opportunities during market dislocations.

As Benjamin Graham, the father of value investing, wisely noted, “The essence of investment management is the management of risks, not the management of returns.” When used judiciously, cash is a powerful tool for managing risk and enhancing long-term returns.

Investors should view cash as a defensive asset and a strategic weapon in their investment arsenal. By maintaining appropriate cash reserves and having the discipline to deploy them when opportunities arise, investors can position themselves to weather market storms and emerge stronger on the other side.

Other Articles of Interest

How to deal with Stock Market Anxiety: Adopt a Winner’s Mindset

First-Level Thinking: Understanding Its Dangers and Limitations

What Is a Contrarian Strategy? Thriving by Defying the Herd

Do famous financial experts profit from your losses?

Can RSI positive divergence truly predict market bottoms?

Probabilistic models for and prediction of stock market behavior

How Options Work for Dummies: Why Patience and Discipline Are Essential

How does consumer market behavior influence stock market trends?

Why should I invest in Exro technologies?

Why should I invest in Apple?

Why should I invest in Microsoft?

Why should I invest in Tesla?

Market Winning Strategy: Rebel, Adapt, Conquer

Why should I invest in Bitcoin?

Why should I invest in gold?

Why Sheep Mentality Meaning Ruins Investment Success?

What’s my socioeconomic status?